Maecenas gravida mauris quis consectetur tempor. Aenean at volutpat enim. Pellentesque eu lacus vulputate, semper arcu nec, dictum felis. Fusce et arcu maximus, faucibus erat non, accumsan odio. Donec vitae semper ante, sit amet feugiat risus. Quisque eu nibh in tortor euismod mattis id id leo. Proin malesuada vehicula nulla, id rutrum dolor fringilla in. Donec in enim metus. Nulla luctus ligula vitae ex aliquam pulvinar. Pellentesque non hendrerit sem. Curabitur placerat, ex ut pharetra ultrices, risus risus fringilla ante, in auctor velit magna vel quam. Donec mattis, elit in iaculis tristique, justo purus pretium enim, vel eleifend dolor lectus eu nisl. Integer id semper turpis.

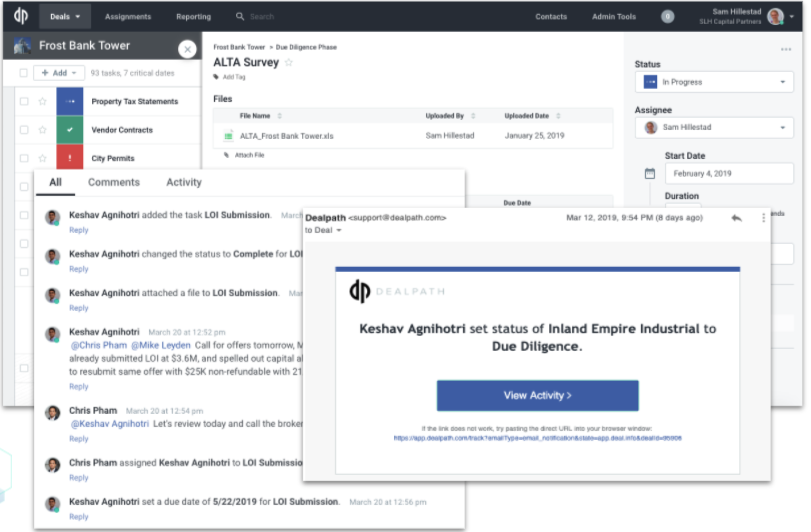

Using Dealpath, Blackstone preserves and leverages institutional knowledge and data to make fast, precise decisions as they invest at a global scale.

| Schedule Demo |

Enterprise-Grade Data Security You Can Trust

Dealpath is SOC2 Type 2 compliant and committed to delivering secure, resilient and highly available cloud-native applications and data services to our clients.

Over $6 Trillion Transactions Evaluated

Using our software's data analysis and reporting capabilities, users have evaluated over $6 trillion in investment transactions--and counting.

If your team is still manually tracking and analyzing investment opportunities in a spreadsheet, there’s a better way.

Used by leading real estate investment management firms like Blackstone, Oxford Properties, and AEW, Dealpath provides the scalability and precision your firm needs to build a leading investment portfolio.

Add power, speed and precision to your investing process with Dealpath’s robust reporting and data analysis capabilities. Leverage proprietary data to vet and compare deals with historical comps.

Review more deals without additional analysts. Configure firm-specific processes that expedite deal flow, while ensuring that every deal in the pipeline undergoes the right due diligence procedures.